Gigafactory

| January 30th, 2020 at 8:40:02 AM permalink | |

| AZDuffman Member since: Oct 24, 2012 Threads: 135 Posts: 18210 |

Or maybe a division of VW. The President is a fink. |

| January 30th, 2020 at 8:55:24 AM permalink | |

| reno Member since: Oct 24, 2012 Threads: 58 Posts: 1384 |

Why are you predicting bankruptcy for a company that is increasing its production volume and market share?   |

| January 30th, 2020 at 8:56:13 AM permalink | |

| reno Member since: Oct 24, 2012 Threads: 58 Posts: 1384 | Shares of TSLA are currently at $646 while I type this. Outrageously overpriced bubble stock. |

| January 30th, 2020 at 10:27:29 AM permalink | |

| AZDuffman Member since: Oct 24, 2012 Threads: 135 Posts: 18210 |

Probably because it is not making a profit in its cars. The President is a fink. |

| January 30th, 2020 at 4:17:16 PM permalink | |

| reno Member since: Oct 24, 2012 Threads: 58 Posts: 1384 |

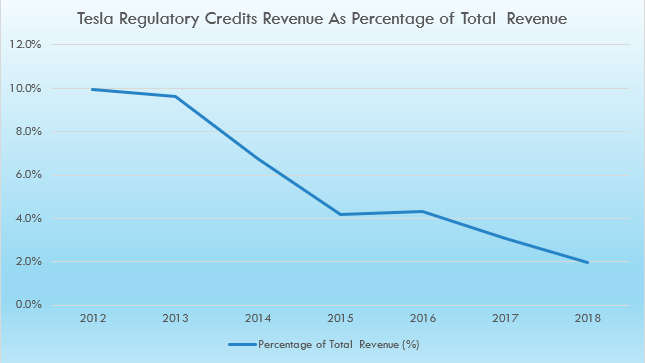

The good news for Tesla is that they are currently far less dependent upon income from regulatory credits (ZEV credits) than they used to be. They sold $594 million in ZEV credits in 2019. Yes, that's a huge number. But their total revenue for 2019 was $24.578 billion. (Revenue from car sales/leasing was $20.821 billion.) So as a percentage of total revenue, ZEV revenue was 2%. As recently as 2013, ZEV credits produced almost 10% of their revenue. Rightly or wrongly, Wall Street is ignoring the ZEV credit sales because investors are more interested in the fact that total vehicle deliveries for the year jumped by 50%, (367,200 in 2019 compared to 245,240 in 2018) which is phenomenal.  |

| January 30th, 2020 at 4:37:43 PM permalink | |

| AZDuffman Member since: Oct 24, 2012 Threads: 135 Posts: 18210 |

They keep having sales and revenue jumps, but not profit jumps. New plants, no new profits. And this is now, when they have pricing power. When more EVs hit they will lose some to much of that. The President is a fink. |

| January 30th, 2020 at 6:20:44 PM permalink | |

| reno Member since: Oct 24, 2012 Threads: 58 Posts: 1384 |

They ended 2019 with $6.3 billion in cash, more than ever before. They aren't going bankrupt. Looking at the graph below, I see a company with a bright future. Are consistent margins ever going to appear? It's going to take awhile. But remember: this company's IPO was barely 10 years ago. Compared to every car company you've ever heard of, this company is an infant in diapers. :format(webp):no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/19656759/Screen_Shot_2020_01_29_at_4.42.35_PM.png) |

| January 31st, 2020 at 4:10:01 AM permalink | |

| AZDuffman Member since: Oct 24, 2012 Threads: 135 Posts: 18210 |

But so much of their cash comes from EV credit sales, same as how more than all of Q4 profit did. But the big problem I see is lack of any much less any consistent "profit conversion." IOW, $1 in new revenue should be giving them say at least $.40 in new profits. Flipped it means they should be growing profit 20% for 15% in new revenue. It has been a few years since I managed a P&L and I never managed one in a manufacturing organization, but these are simple concepts that really matter. 2015-2018 the more he sold the more he lost. 2018-2019 his revenue is choppy and not growing. His answer now is "Model Y" and "new China factory" but what does that matter if he has no gross profit on the cars? There are some other challenges going forward. After 2021-22 he will have way more EV competition. So far TSLA owns the EV market to the point it is fair to say people who want an EV want a TSLA. But as EV SUVs hit the market that will change a bit. If FoMoCo brings out that new Mustang thing and it does not sell they will shove on the incentives. Ditto when GM gets some EVs out. IMHO the EV market is at the moment at best 5% of the market. TSLA has been selling kind of like Honda in the early 80s. "You want one? Take this or leave it, someone else will take it if you do not." IOW, it comes down to how big is the TSLA cult? How big is the Musk cult? The President is a fink. |

| February 3rd, 2020 at 2:28:59 PM permalink | |

| reno Member since: Oct 24, 2012 Threads: 58 Posts: 1384 |

I wrote that on Thursday, January 30. So now 4 days later Tesla shares are at... $780. |

| February 3rd, 2020 at 2:38:43 PM permalink | |

| reno Member since: Oct 24, 2012 Threads: 58 Posts: 1384 |  |